Election years are known for increased market volatility and generally lower stock returns due to the uncertainty elections bring. Historically, the S&P 500’s average return during election years has been 6.2%, compared to 9.6% in non-election years. Volatility is also higher, averaging 16.5% in election years versus 15.3% in non-election years. Since 1980, the average annual market drop was 14.2%, but this increased to 16.3% during election years and dropped to 13.5% in non-election years.

Notable Volatile Election Years

Recent election years like 2000, 2008, and 2020 have been especially volatile. In 2000, the market dropped due to the tech bubble burst. The 2008 financial crisis caused another significant drop, and in 2020, the pandemic led to a sharp market crash and subsequent recovery.

Market Behavior Before and After Elections

Markets often become more volatile before elections, but this uncertainty typically clears after election day as markets shift focus back to fundamentals. Historically, returns in the first three quarters of an election year averaged 1.9%, increasing to 3.1% in the fourth quarter since 1936.

The 2000 and 2008 elections saw significant market reactions. The 2000 election’s delayed results led to a 4.2% market drop between the election and the Supreme Court ruling on December 12. Conversely, in 2020, the market rose 4.2% between election day and the Saturday following when results were declared.

The Risks of Market Timing

Market timing around elections can be risky. In 2016, despite an initial drop in futures, markets closed 1.1% higher on election day. Both 2016 and 2020 saw a pre-election rally, with markets rising 3% between the Friday before and election day. Investors who wait for election uncertainty to pass risk missing rapid post-election rebounds.

Implications on Debt and Deficits

In the long run, economic policy, rather than politics, has a significant impact on the economy and markets. Federal finances, particularly the deficit, will likely be a major topic of debate, especially after bond yields rose in 2023 due to fiscal concerns.

In 2023, the federal budget deficit was $1.7 trillion, or 6.3% of GDP, surpassing the 50-year average of 3.7%. This figure includes a $333 billion deficit reduction from a student debt forgiveness program invalidated by the Supreme Court in June 2023. Without this adjustment, the deficit would have been over $2 trillion, or 7.5% of GDP. The deficit in 2022 was $1.4 trillion, or 5.4% of GDP, including the unspent student loan forgiveness funds. Before the pandemic, the deficit did not exceed $1 trillion, with 3.8% of GDP in 2018 and 4.6% in 2019. The Congressional Budget Office expects deficits to range between 5-7% annually over the next decade, likely pushing U.S. debt to GDP well above 100%.

New borrowing is happening at higher interest rates after the Federal Reserve increased rates by 5.25%. As a result, net interest payments on the debt will significantly contribute to the deficit. In 2023, net interest payments were $659 billion, up from $413 billion in 2021 before rate hikes began.

How Should Investors Approach Investing in an Election Year?

Political opinions should be kept out of your investment decisions. One key rule is: Don’t let your political views influence your investment strategy.

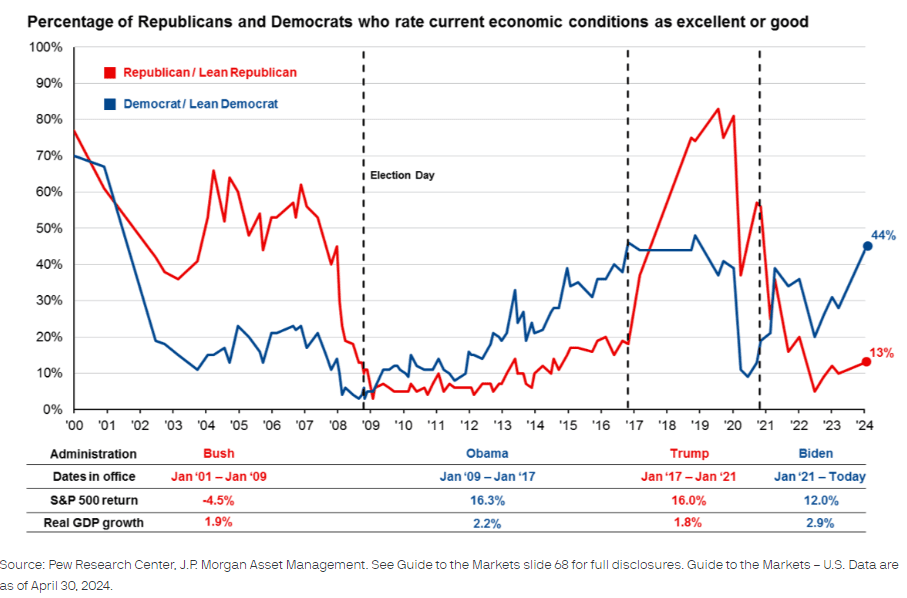

A survey from the Pew Research Center shows that Republicans tend to feel more positive about the economy under a Republican president, while Democrats feel the same under a Democratic president. These feelings often affect how people invest.

However, during both the Obama administration (16.3% average annual return) and the Trump administration (16.0%), S&P 500 returns were almost identical and significantly higher than the 30-year average of 10.4%. This suggests that factors like low interest rates had a greater impact on returns than the presidents’ policies.

Investors who let political biases influence their investment choices might have missed out on these strong returns during administrations they didn’t favor.

While election years bring uncertainty and volatility, sticking to a disciplined investment strategy and focusing on long-term fundamentals can help navigate the ups and downs. Political opinions should stay at the polls, not in your portfolio, ensuring you don’t miss out on potential returns.