In 2024, U.S. large cap stocks had a strong start, jumping by 10.6% according to the S&P 500 index. This surge came after a solid performance in the previous quarter. While most major regions saw gains in equities, U.S. stocks continued to lead the pack. Japan was the only market to surpass the U.S., with gains of 10.6% in U.S. dollar terms and an impressive 18.8% in local currency terms. Emerging market stocks saw modest growth of 2.2%, mainly due to weaknesses in Chinese equities. However, the strengthening U.S. dollar, rising by about 3%, didn’t benefit international equity returns for U.S.-based investors.

Within the U.S., large cap stocks remained ahead of small cap stocks, and growth stocks outperformed value stocks. Treasury yields increased in the first quarter, driven by rising real yields from positive economic growth surprises. Inflation expectations also rose. Apart from slightly positive returns for cash and high yield bonds, fixed income sector returns were generally negative. High yield bonds performed the best among fixed income sectors, with higher yields offsetting the rise in interest rates. In the real assets realm, natural resources saw strong returns, while global real estate had a slight setback from the previous year’s gains.

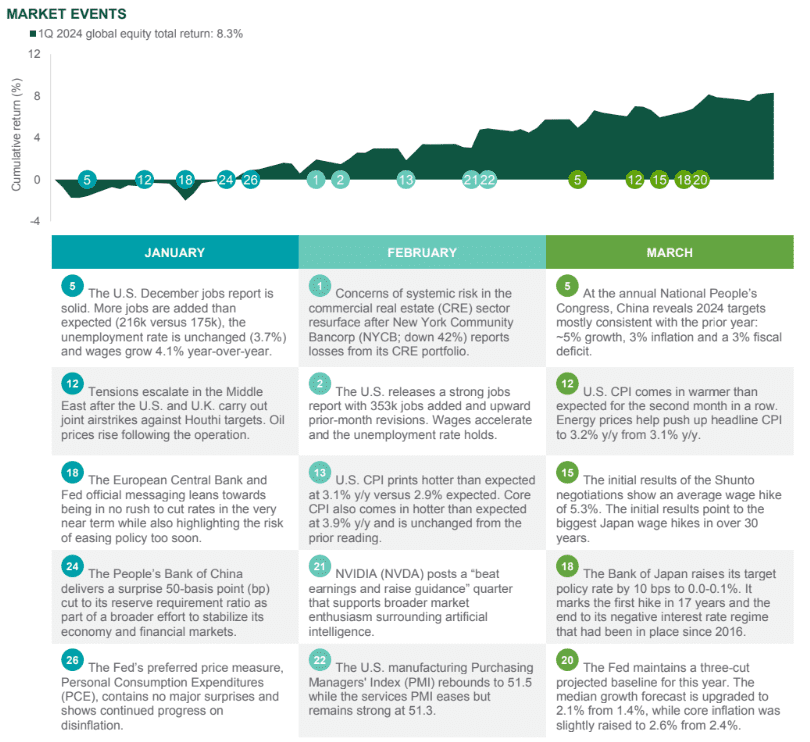

The strength in domestic equities was supported by the resilience of the U.S. economy and an improving earnings outlook. Investor confidence was boosted by the U.S. economy’s ability to handle restrictive monetary policies. The Federal Reserve’s dovish stance, hinting at a potential end to rate hikes and the start of easing measures, also contributed to market optimism. Although there were initial expectations for multiple rate cuts, strong inflation readings in January and February led to a revision in expectations, with fewer cuts anticipated. While risk assets have held up well amid these adjustments, concerns about high valuations and persistent inflation could pose challenges for stock market stability in the future.

Interest Rates

Interest rates witnessed a significant shift during the quarter, with shorter-term Treasury yields rising by approximately 30-40 basis points (bps). Market expectations for Federal Reserve rate cuts in 2024 decreased from over six to under three, with uncertainty prevailing over the timing of the first rate cut—whether in June or later in the year. Despite positive surprises in growth and inflation data, policymakers are proceeding cautiously, aiming for a balanced adjustment. However, the Fed still foresees multiple rate cuts by year-end to address inflation concerns.

Credit Markets

Credit markets experienced incremental tightening, reflecting a robust macroeconomic environment and favorable technical conditions. Spreads tightened for both investment-grade (IG) and high-yield (HY) bonds, reaching levels significantly below historical averages. While IG fixed income faced some headwinds due to higher interest rates, HY bonds managed to make gains.

Equities

Global equities demonstrated strong performance, with U.S. equities leading the pack with a 10.0% gain. This upward momentum was fueled by investor optimism regarding a potential soft landing for the economy. Developed ex-U.S. equities also saw solid gains, while emerging market equities recorded more modest increases, with China equities experiencing a slight loss. Despite the rise in interest rates, expectations for global earnings growth and ongoing central bank support buoyed equity markets.

Real Assets

Real assets, encompassing global real estate, listed infrastructure, and natural resources, witnessed mixed performance, trailing global equities. While listed infrastructure and natural resources recorded modest gains, global real estate ended slightly in the red. Factors such as higher interest rates and market sentiment likely influenced returns, with idiosyncratic impacts also contributing to sector-level performance variations.

For Insurance press releases please see https://www.oiminsurancecenter.com/