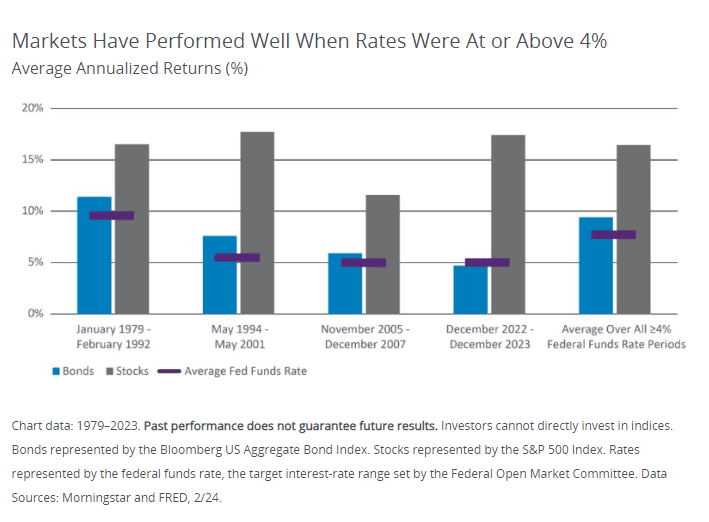

Historically, stocks and bonds have shown solid performance during periods when interest rates were above 4%.

Key Takeaways:

- The current environment of higher interest rates may feel challenging, as they followed a long period of exceptionally low rates.

- Markets have historically performed well when interest rates were at or above 4%

- There’s no need to wait for lower interest rates to start investing in stocks and bonds.

After over a decade of ultra-low interest rates, adjusting to higher rates has been a challenge. However, these “high” rates are actually a return to historical norms: Rates above 4% were common prior to 2008.

Historically, higher interest rates have been beneficial for investors, with stocks and bonds delivering strong returns during periods with rates above 4%.

Market Performance with Rates at or Above 4%

Average annualized returns (%) for stocks and bonds from 1979 to 2023 suggest that past performance does not guarantee future results. Bonds are represented by the Bloomberg US Aggregate Bond Index, while stocks are represented by the S&P 500 Index. Rates are based on the federal funds rate, set by the Federal Open Market Committee.

Understanding the Federal Funds Rate

The federal funds rate, the overnight lending rate between banks, influences everything from mortgage rates to interest earned on savings accounts. Higher rates can benefit savers but may pose challenges for borrowers.

The Federal Reserve’s Federal Open Market Committee sets the federal funds rate. It can lower rates to stimulate borrowing and economic growth, as it did after the Global Financial Crisis. This period of near-zero rates lasted unusually long, making low rates seem normal.

Conversely, the Fed can raise rates to control inflation, discourage borrowing, and slow an overheating economy. The recent rapid rate increases following the COVID-19 pandemic created challenges for investors, as both stocks and bonds performed poorly due to the abrupt rate hikes.

Adjusting to the Not-So-New Normal

The positive news is that the initial shock of rising rates appears to be subsiding. Federal Reserve officials have indicated a willingness to be patient and proceed cautiously when it comes to lowering rates. This suggests they anticipate ongoing economic stability.

With a historical track record of strong performance during periods of higher rates, waiting for a “better” time to invest could mean missing out on opportunities for both stock and bond investors. It may be wise to consider the current environment as a return to more typical interest rate levels and plan investment strategies accordingly.